Beware of Custodianship Shells and Reverse Mergers

The Securities and Exchange Commission (“SEC”) says it doesn’t like over-the-counter shell companies especially when reverse mergers are involved, and would like to see them gone from the marketplace. To that end, its Enforcement Division cooked up an initiative it called “Operation Shell-Expel”. It began with a bang on May 14, 2012, when the agency coupled an announcement of Operation Shell-Expel with the suspension of trading in the stock of 379 dormant penny companies. It was, the SEC said, the largest such action in agency history. If Operations Shell Expel was such a priority to the SEC why is that we were able to locate more than 700 dormant public companies in the state of Nevada with minimal effort? What danger do these sorry companies present and if they are so dangerous why are there so many dormant shell companies still out there being fraudulently taken over?

The existence of empty shell companies can be a financial boon to stock manipulators who will pay as much as $750,000 to assume control of the company in order to pump and dump the stock for illegal proceeds to the detriment of investors. But with this trading suspension’s obligation to provide updated financial information, these shell companies have been rendered essentially worthless and useless to scam artists.

The shells were “rendered essentially worthless” because the suspension meant they’d be delisted to the Grey Market, the graveyard of bad pennies, in which market makers are forbidden to publish quotes.

Critics of rampant abuse in the OTC market cheered the SEC on, hoping Operation Shell-Expel signaled a new, and far less tolerant, attitude toward dormant shells that were often serially pumped and dumped. The following June, the agency suspended trading in another 61 issuers, and in February 2014, it followed up by shutting down another 255 shells. The hammer came down on 128 more in March 2015. There’s been no similar action in 2016. At the time of the 2015 suspensions, Enforcement director Andrew J. Ceresney remarked, “We are getting increasingly aggressive and adept at ridding the microcap marketplace of dormant shells within a year of the companies becoming inactive.” Many market participants see the SEC’s failure to pursue corporate hijackers of dormant shells as one of the greatest enforcement failures of the penny stock markets in the last decade. We have identified hundreds of hijacked tickers and/or companies involving fraudulent state court actions such as with minimal effort yet these types of shell companies continue to be hijacked by two or three penny stock law firms who assist the hijackers or sell the vehicles to unsuspecting companies seeking public company status. Our research reveals these shells have been used as the vehicles for many of the largest and most publicized securities fraud cases pursued by the Department of Justice and SEC. Yet there are at least 740 of these companies domiciled in the state of Nevada alone.

The victim losses are easy to locate using press releases of regulators who pursue buyers of the vehicles from the hijackers after they have been used in fraudulent schemes and investors have been harmed. The most common method to obtain control of these issuers is by the use of custodianship proceedings. The legal issues surrounding these proceedings are not complicated and involve fraud as well as securities related crimes. A common pattern in these hijackings involves the filing of a fraudulent affidavit or pleadings in a state court proceeding in order to obtain control of the public vehicle. Unsuspecting state court judges have become pawns in the scheme. In fact our research indicates that multiple penny stock law firms have been built using fraudulent custodianship shells.

Taking Control of a Dormant Shell Company

Shell companies are commonly promoted as desirable for small private businesses wishing to go public. Their chief selling point is that all the buyer need do is reverse-merge his business into the shell, and he’ll be up and running. A public company will have greater visibility, and public company status will offer the possibility of raising money by selling securities or entering into debt financing. Theoretically, the going-public process will be much easier and faster for the private buyer than if he decided to start from scratch. Initially, no filings with regulators—the SEC or the Financial Industry Regulatory Authority (FINRA)—are required, and the reconstituted public entity will be the buyer’s to do with what he pleases as soon as its corporate charter is amended in its state of domicile.

The reality can be different. While no time need be wasted finding a sponsoring market maker to file a Form 211 with FINRA, a process that can take months, depending on the circumstances, FINRA will become involved should the new company decide to change its name and ticker symbol after a reverse merger. At that point, FINRA may ask questions, and the Depository Trust & Clearing Corporation may conduct a review putting electronic trading at risk. If the shell has skeletons in its closet, they may make an unexpected appearance after the buyer has made his commitment.

Buyers of shells may be inexperienced small business owners looking for a quick and easy route to public status, or, as the SEC suggests, they may instead be fraudsters seeking cheap vehicles they can use in pump and dump operations. One thing to keep in mind when drawing conclusions about the buyers of these vehicles is that legitimate small businesses going public are penny stocks and the management of these small businesses typically have little or no experience in the public markets. Since at least half of the jobs in the U.S. are from small businesses, regulators need to take steps to protect small businesses seeking public company status. Our research reveals that the opposite is true and in fact, small businesses going public have been the target of regulators for decades while the complicit shell hijackers have gone unscathed.

Back in the 1990s and early 2000s, many shells were registered with the SEC, either as blank check companies or as development stage companies that were no more than a vague business plan. The attorneys who created these fully reporting shells could command good prices for them; as much, it was said, as $750,000. But in 2008, the SEC revised its Rules 144 and 145. What that meant for shells, whether reporting or non-reporting, was that unless certain requirements were met, Rule 144 would not be available to holders of restricted stock. The companies could sell restricted stock, but they could not resell it until the company had ceased to be a shell and filed “Form 10 information” with the SEC for a full year. These rules applied to former as well as current shell companies.

The SEC’s rule change made life difficult for attorneys who’d made a nice living creating cookie-cutter blank check companies. Shells that had been sitting on the shelf for years, and former shells up for resale suddenly lost much of their value. Since the new rules became effective, initial registration statements for OTC issuers have taken pains to present the company as an operating business of some kind. There are lawyers who specialize in preparing Form S-1 registration statements for entities that claim not to be shells, but in fact are. The offering registered by the S-1 is usually small, as management claims its financial needs in this early stage of development are modest. Often the company has a sole officer/director. Once the registration statement is deemed effective, nothing happens for a year or so. At that point, the company, in reality a shell, is sold to a new private business. Stock issuances and perhaps a forward split ensue. Finally the company finds a sponsoring market maker to submit a Form 211 to FINRA and apply for a ticker. Only then does the company begin to trade. Often, a pump and dump follows shortly.

During the same period, the former Pink Sheets changed its name to OTC Markets Group, and sought to lend an air of plausibility to non-reporting issuers. OTC Pink Sheet companies are not required to make any periodic financial reports, or any other kind of reports except Form D, to the SEC if they conduct a Regulation D offering. They can, if they wish, remain largely dark, disclosing only positive information in press releases and at their websites. For some time, OTC Markets has been encouraging these issuers to post annual and quarterly financial reports, along with other disclosures, at its website. That isn’t free—for Pinks, the OTC Disclosure & News Service costs $5,000 a year—but many issuers feel the price is well worth paying. Although the quality of information provided by what OTC Markets calls “Pink Current Information” companies is often woefully inadequate if judged by SEC standards, investors evidently feel some information is better than none at all, and have come to place their trust in Current Information issuers. Sometimes they even confuse them with SEC registrants, incorrectly referring to them as “fully reporting.”

One result of all this is that Pink shells are now in greater demand than once upon a time. Significant numbers of shell peddlers have stepped up to meet that demand. There are so many, in fact, that the price of shells the vendors promise are “clean” has dropped well below $100,000 in most cases. Where shady lawyers are involved, the shells are peddled with necessary legal work included.

Putting together a stable of shells for sale is not difficult. One method is for the shell purveyor or his or her associates to apply for custodianship of a dormant or inactive public shell in its state of domicile. Many dormant Pinks are Nevada companies, and so Nevada is a familiar choice for these fraudsters. All the would-be shell peddler need do is locate a Nevada public company that’s been abandoned or is inactive, and its corporate charter consequently revoked. The peddler would then purchase a few shares of stock and apply for custodianship on the grounds that he has a financial interest in the company and wishes to reinstate it for the “benefit of the shareholders”. His or her attorney will submit filings that supposedly demonstrate his probity and good intentions, and will pay the state $270 to file a legal action. After a few routine hearings, the custodianship will be granted by an unsuspecting Nevada judge. Though a few follow up filings are required, they rarely happen and when they do, the filings omit material information. At that point the new custodian will sell the shell to anyone interested.

Beware of Lawyers Seling Shells

In recent years Adam Tracy, a Chicago area securities attorney, has become a big player in the shell business. At the website for his sole practice, Securities Compliance Group, he describes himself as offering “full-service consulting and legal assistance” to businesses of all kinds, emphasizing his experience with the reverse merger process. Tracy deals in both kinds of shells described above. As an attorney, Adam Tracy compiles and opines on Form S-1 initial registration statements, and applies for custodianship of dormant Nevada shells. In addition, he occasionally acquires shells from other vendors, and has bought at least two shell companies from bankruptcy trustees.

Last fall, the SEC selectively began to take an interest in Tracy’s Form S-1 registration statements. On October 28, 2015, the Commission issued an order of investigation into 15 issuers that had filed S-1 registration statements between March 2014 and August 2015. The order stipulated that information reported by SEC staff “tends to show” the filings were fraudulent in a variety of ways. It empowered staff attorneys to “administer oaths and affirmations, subpoena witnesses, compel their attendance, take evidence, and require the production of any books, papers correspondence, memoranda, or other records deemed relevant or material to the inquiry…”

Beginning on November 3, 2015, the SEC attorneys from the Atlanta Regional Office issued and served six subpoenas on Securities Compliance Group, Adam Tracy, and his paralegal Megan Ruettiger. Though Adam Tracy hired an attorney—Alexander James Rue, who’d until a few years ago worked for SEC Enforcement in Atlanta—the documents required were not produced, and no testimony was scheduled. Nearly nine months later, on June 15, 2016, the SEC filed an application in federal court in Atlanta for an order to show cause, and for an order requiring Securities Compliance, Adam Tracy, and Ruettiger to comply with the subpoenas they’d been sent. While the investigation had been confidential, the court filings put the matter including the SEC’s formal order into the public domain.

The filings are of considerable interest. The SEC’s memorandum in support of the application clearly explains the reasons for the agency’s interest in Adam Tracy, and also tells a strange tale of Tracy’s apparent disinclination to comply.

The SEC begins by explaining that it’s investigating “possible violations” including “engaging in, or intending to engage in, offering frauds.” It describes these alleged offenses in greater detail:

Since April, 2014, fifteen corporations have filed with the Commission similar Form S-1 and Form S-1A registration documents and amendments to register initial public offerings with Tracy acting as either the drafter of the documents, providing a legal opinion on the registration statement, or both. These filings have common characteristics and indicate that some of these companies: (1) may not appear to be viable developmental stage companies; (2) may be seeking to create fraudulent shell companies that evade requirements applicable to offerings by “blank check” companies under Rule 419 promulgated under the Securities Act of 1933 (“Securities Act”); or (3) may have failed to disclose the identity of their true control persons, promoters and gatekeepers.

What the SEC suggests—that Tracy was hired by one or more unknown persons to create the shell companies, make it look as if they were operational entities, and install one or more front men as officers and directors—has become increasingly common in recent years, and is a problem that’s attracted the agency’s attention. In January 2015, the SEC moved against Canadian penny stock attorney John Briner, Colorado attorney Diane Dalmy, and several accounting firms for their roles in the creation of 20 fraudulent shell companies. According to the SEC, Briner controlled the entities, and recruited friends and business associates to act as officers and directors; some of them were pursued by the SEC as well. Dalmy allegedly opined on the Form S-1 registration statements. The accountants conducted audits “so deficient that they amounted to no audits at all.” Very likely Briner’s plan was eventually to resell his newly created SEC reporting shells to companies seeking public company status or others who may well have pumped and dumped them.

In our opinion, the SEC suspects Tracy of participating in a similar scheme. But its efforts to obtain the information subpoenaed were thwarted for many months, as Edward Saunders, the SEC attorney investigating the case, explained in a declaration submitted to the Atlanta court. Things began well enough; Adam Tracy’s attorney Rue called Saunders in early December and promised to send the material the next day. When Saunders hadn’t received a package 10 days later, he contacted Rue. Rue once again promised to deliver the documents that afternoon. Rue’s runaround continued into January. Once he even declared that he had sent the package, but nothing was received by Saunders. Through February and the first half of March, Rue continued to tell Saunders that the material was literally “in the mail.” It was not. Finally, on March 14, 2016, a package arrived. It contained a substantial number of documents, but according to Saunders, “859 pages were either completely blank, unreadable due to illegible copies or duplicates of documents produced.”

Worse yet, none of the documents had any bearing on the matters being investigated by Saunders. Court documents reflect that when Saunders finally spoke to Rue again, Rue told him he’d accidentally sent documents Adam Tracy had prepared for an entirely different investigation being conducted by a different SEC office. Saunders must have wondered if he’d stepped into an alternate universe. There’s no way to tell what this second investigation is about; Saunders said merely that it referenced two companies unrelated to his own interests. It’s unclear whether Adam Tracy is a potential target, or merely a witness.

On July 13, Tracy, newly aware of the SEC’s action in the Atlanta federal court, submitted a response in which his new attorney Stephen Council explained that Adam Tracy and Ruettiger had not intentionally disregarded the SEC’s demands: the fault was to be laid at Alex Rue’s door. On December 3 and 4, Tracy had sent Rue two copies of “documents responsive to the Commission’s subpoena.” Rue assured him several times that the documents had been produced to the SEC, or would be soon; Adam Tracy had no idea that the promised production never happened, or that at one point Rue sent Edward Saunders the wrong documents. He only learned of the SEC’s action in the Atlanta court through an RSS feed once the action had been filed, and immediately terminated Rue as his counsel.

The material Tracy had sent to Rue in early December was, he said, “non-privileged [and] responsive.” Yet evidently it was only responsive in a rather limited way. The subpoena had, for example, required him to produce all correspondence related to the 15 companies under investigation, all documents created in connection with the compilation of the Forms S-1 for those companies, phone records, instant messages, and more. In July 2016, Tracy noted that the “vast majority of responsive documents relate to his clients and appear to be privileged.” He added that he’d already made an initial production on July 11, and was “working diligently to confirm that they have provided all responsive documents to their new counsel who will continue to supplement the document production as soon as practicable.” It is not at all clear whether that production would include the “vast majority” of material Tracy considered to be privileged.

On September 8, the SEC dismissed the Atlanta action without prejudice; as Tracy had assured the agency of his continued cooperation. That does not mean the investigation is over, only that Tracy wll produce the information requested by the SEC’s subpoena enforcement action. No further details will be made public by the SEC until and unless an enforcement action is brought.

Tracy Enters the Nefarious World of Shell Purveyors

Around the time Tracy began writing the S-1 registration statements, he decided to boost his business by obtaining and selling dormant public shell companies. This was not a secret strategy. Tracy announced announced it in a press release issued on January 23, 2014. Tracy isn’t alone. At least one South Florida attorney has sold hundreds of shell companies most obtained using fraudulent custodianship filings.

The idea wasn’t yet fully developed. Originally, Tracy planned to seek shareholders of abandoned Pink Sheet companies, and bring actions to “place such neglected entities under the control of state and federal courts across the country.” He added that he expected to file his first petition in the Federal District Court for Northern Illinois by February 1, 2014. It isn’t clear what kind of petition that would have been, as applications for custodianship must be filed in the appropriate state court. Perhaps it somehow involved bankruptcy, but it’s hard to see how he’d have persuaded one or more creditors to throw the company in question into involuntary bankruptcy, much less get himself named receiver or trustee. He would later gain control of at least three bankruptcy shells, but in none of those cases was he involved in the bankruptcy itself.

Calculating that “millions upon millions of aggrieved shareholders” must still own stock in abandoned companies, he urged such people to contact him. Perhaps he initially planned to name those longtime shareholders as custodians, or perhaps he simply thought they’d be of help in identifying the dormant shells he sought for his reverse merger inventory.

Tracy was generally familiar with the custodianship process. In a custodianship petition from July 2016, he indicates he’d “acted as counsel to the court-appointed custodian” on seven earlier occasions. The public shells in question were AdSouth Partners Inc (formerly ASPR), DIBZ International, Inc (DIBZ), SIPP Industries, Inc (SIPN), Chenghui Reality Holding Corporation (CRHO), Osyka Corporation (OSKA), Eastern Environment Solutions Corporation (now Precicion Trim, Inc., PRTR), and China Infrastructure Investment Corp (formerly CIIC). It’s not clear what Tracy’s role was; his name appears in none of the Nevada court documents. He may simply have been lending a hand to the shell vendors who took control of the seven companies. The one thing all have in common is that the cases were handled by a Nevada attorney. Tracy is not licensed to practice in Nevada and, would later use the same attorney for some of his own custodianship applications.

The remaining four custodianship actions in which Tracy says he assisted are more recent. The petitions were all granted in 2015. The custodian of Chenghui Realty Holding Corporation and Osyka Corporation was Ketcher Industries LLC, which entered the shell business in Nevada in 2014. Ketcher Industries LLC should not be confused with Kitcher Resources, Inc a custodianship shell controlled by the FBI in an undercover operation that resulted in multiple indictments of penny stock participants.

Tracy’s Nevada Shells

Evidently the work Tracy did for his clients in the custodianship shell business persuaded him that acquiring dormant Nevada shells was easy, and could be profitable. He didn’t begin immediately after he put out his press release on the subject. He waited nearly two years, applying for his first two custodianships—of China Ivy School, Inc (CIVS) and Sunset Suits Holdings, Inc (SNSX)—on November 25, 2015. He was appointed custodian of both in early 2016. The name he used as custodian was Barton Hollow LLC. Barton Hollow is a Nevada company he formed in February 2014, apparently for the sole purpose of obtaining control of shells. His first two applications were quickly followed by others. To date, Tracy has brought more than 50 custodianship actions in Nevada.

The prospective custodian of a dormant Nevada company must meet requirements set by state law. First, he must be a shareholder of the company. We know from court filings that Tracy’s paralegal, Megan Ruettiger, purports to purchase 1000 shares of stock of each entity he’s interested in before he files a custodianship petition. A custodianship action may be brought in two circumstances: if the company directors are so divided that any vote they may take would be split; and if the business has been abandoned, and no steps have been taken to dissolve, liquidate or distribute its assets. Tracy relies on the second option, seeking shells whose management has not made any filings with the state for several years.

The applicant must also provide certain information specified by the Nevada statute, along with an affidavit in which he swears to its truth and accuracy. He must include a list of all previous applications for custodianship of a publicly traded company filed in any jurisdiction; if those applications were granted, he must supply a detailed description of the activities he performed as custodian including reverse stock splits and share issuances. The custodian must also append a description of the current corporate status and business operation of those companies. He must in addition disclose “any and all previous criminal, administrative, civil or National Association of Securities Dealers, Inc., or Securities and Exchange Commission investigations, violations or convictions concerning the applicant and any affiliate or subsidiary of the applicant.” That would include sanctions by the Commodity Futures Trading Commission (CTFC), and any state or federal actions, no matter how old. We note many custodians hiding behind their affiliates such as corporate egos to conceal required disclosure of background matters despite representing to the court that no such matters exist. Examples of administrative actions includes actions by the CFTC, state and federal administrative actions no matter how old. These high standard of disclosure was created because custodians are fiduciaries to the other shareholders of the corporation whom they are obligated to protect even above their own self interest. Lastly, he must provide evidence of an attempt to contact the officers and directors of the company in question. That is practically achieved by serving them through the company’s resident agent, if it still has one, or by mail at the company’s last known address.

If the custodianship is granted, the applicant must set a date for a shareholder meeting, and inform all shareholders of record of it; he must then inform the court of actions taken at the meeting. He must also reinstate or maintain the company’s corporate charter, and show that he is “continuing the business and attempting to further the interests of the shareholders.” Unfortunately, custodians of dormant penny shells often disregard those fiduciary duties, performing reverse splits and other actions that may affect the size and value of the holdings of the very shareholders the custodian is obligated to protect. These actions are taken to make the vehicle more attractive to a potential buyer. Once the vehicle is purchased, the custodian and his associates pocket the proceeds from the sale as payment for their purported “services” as a fiduciary and custodian.

We’ve examined Tracy’s application for custodianship of a company called Clean Hydrogen Producers, Ltd (CHPO) to see whether it meets the requirements specified by the Nevada statute. The action was filed on July 20, 2016, along with nine others. In the application, Tracy dutifully notes that he’s filed 35 prior applications, lists them, and reports which have been granted. For each that has, he provides an update on its status. In his discussion of China Ivy School, of which his custodianship was granted on 27 January 2016, he says “the reinstatement has been submitted with the Nevada Secretary of State and the transfer agent and is pending.” It is difficult to imagine that a simple reinstatement would take six months. In fact, CIVS has not been reinstated in Nevada to this date. He also claims a shareholder meeting had been noticed, and was pending. In reality, it appears to us that usually he doesn’t reinstate his companies’ corporate charters until he’s made a sale of the public shell for a reverse merger; the cost of reinstatement is, as we shall see, included in the cost of his shells.

Tracy says specifically: “Petitioner has not been the subject of any previous criminal, administrative, civil or National Association of Securities Dealers, Inc. or Securities and Exchange commission investigations, violations or convictions.” He swears to that under penalty of perjury in the affidavit he supplied to the court. As noted, he filed the application on July 20, 2016. He’d known since early November 2015 that the SEC was investigating the allegedly fraudulent Forms S-1 he’d written in 2014 and 2015.

Evidently the judges to which Tracy’s custodianship actions were assigned found his applications adequate and unremarkable, and granted them routinely. Clean Hydrogen was an exception. The case was dismissed on September 27; the judge hearing it believed it belonged in Business Court, and Barton Hollow requested a voluntary dismissal.

Selling the Shells

By the spring of 2016, Tracy had assembled a sizable collection of public shells. Now he needed to sell them efficiently. To that end, he began to prepare lists of available shells, and post them publicly. We’ve made a spreadsheet based on information from the lists, the Nevada court, the Nevada SOS database, OTC Markets, and more. In the past year, Tracy’s had at least 57 shells on offer, and may have sold as many as 21 of them. He didn’t obtain all of them through custodianship actions. Integrated Cannabis Solutions (IGPK), for example, is a company he once merely represented, but on January 11, 2016, its old management resigned and Tracy took over as sole officer and director. Another individual became custodian of Triad Pro Innovators (TPII) in June 2015; it’s unclear how Tracy later gained control. He appears to be in the process of selling it: it was reinstated in Nevada on August 22, 2016, and a new officer list was submitted, but there’s no new disclosure explaining the company’s situation at OTC Markets. A few others came into Tracy’s hands by unknown means, but most of his wares are his own custodianship shells.

Some custodians reinstate their dormant Nevada companies immediately, but Tracy does not. If a company has been delinquent in Nevada for years, reinstatement fees can be high, as much as $15,000 or more. Tracy notes the cost of reinstatement on his lists. It seems that once he’s made a tentative deal, his first move is to reinstate the company, at least as long as the buyer ponies up. He then posts a new officer list in Nevada. If the company resides on the Pink No Information tier at OTC Markets, he waits till the buyer has paid to use the OTC Disclosure & News Service before making changes to the issuer’s profile page or submitting new filings. As the individual profiles on the lists show, he also issues himself convertible debt to ensure his control. The new owner will purchase the debt; it’s included in the price of the shell.

The shells are relatively inexpensive, at least as far as the costs disclosed indicate. The priciest of the current crop is iGlue (IGLU), at $85,000. The cheapest is China Global Media Inc (formerly CGLO) at $5,000. But CGLO is entirely worthless; its registration was revoked by the SEC for delinquency on 26 August 2016.

Tracy’s moneymaking opportunities don’t end with the sale of the shell. In most cases, after the deal is finalized, he’ll become the company’s legal counsel. He’ll also become its investor relations representative through Pacifix Financial, one of his many finance-related companies. He also owns a transfer agency called Cathedral Stock Transfer. Although Cathedral appears on the OTC Markets Service Providers list, it has no clients listed. While owning a transfer agency could be very convenient for a shell peddler, it might also be considered a conflict of interest, and potentially problematic in other ways. Tracy formed the agency in Louisiana in 2012; it’s recently lost its good standing status for failure to file a required annual report. He owns yet another company of potential use to the penny stock crowd: Rule 144 Direct, LLC. Calling himself an “expert attorney,” he promises to find “creative solutions related to aged stock, convertible debt, and other complex liquidity issues.”

Buyers of shells who intend to reverse-merge their private companies into those shells naturally want to change the name and ticker of their newly-acquired public company to reflect its new business. In order to do that, they must make a corporate action request to FINRA. So far, only Sunset Suits, one of the first two companies Tracy took control of in Nevada, has done that. Tracy obviously found new buyers very quickly: he was granted custodianship on January 4, 2016, and reinstated Sunset’s corporate charter on 28 January. The company’s name and ticker were changed to Honsen Energy & Resources International Limited and HSEN on July 6, 2016. HSEN has been making disclosure at OTC Markets. On Monday, October 24, the company’s stock split 1:100; the company has made no announcement about the reasons for the split.

Sooner or later, there will be more symbol and name changes for Tracy’s shells, and more reverse splits. While some buyers will be ordinary business people looking to go public on the cheap, others will no doubt use their new shells for pump and dumps and other manipulations the SEC says it deplores.

Where Are the Regulators?

The SEC is investigating Tracy’s activities in at least one jurisdiction but could they really be unaware of his dozens of custodianship actions in Nevada? They certainly shouldn’t be. So far, he’s filed eight Forms 15 to terminate registration of shells that are delinquent filers. Another 12 of his shells are currently delinquent filers. The agency could easily suspend those shells and revoke their registration, effectively removing them from the marketplace. No investigation is required; a delinquent filer’s delinquency is a matter of fact that cannot be challenged.

FINRA might be able to block, or at least delay, corporate actions—name and ticker changes, reverse splits—like those described above. Rule 6490, which governs FINRA’s processing of corporate action requests, allows the regulator to deny an action in certain circumstances. The Tracy shells would qualify under:

FINRA has actual knowledge that the issuer, associated persons, officers, directors, transfer agent, legal adviser, promoters or other persons connected to the issuer or the SEA Rule 10b-17 Action or Other Company-Related Action are the subject of a pending, adjudicated or settled regulatory action or investigation by a federal, state or foreign regulatory agency…

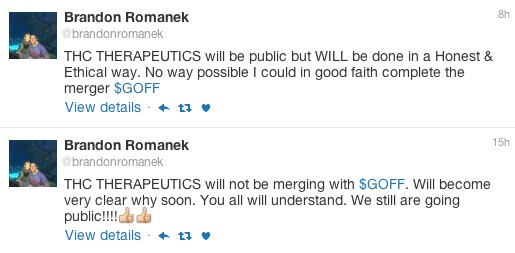

Perhaps that’s why only one of the shells sold by Tracy—one of his very first—has completed a corporate action request with FINRA. If doing so proves difficult for new management of shells he’s sold more recently, problems could arise. It seems something’s gone wrong with one of the companies Tracy unloaded earlier this year. He applied for custodianship of Goff, Corp (that was the name, complete with conspicuous misplaced comma, it used as an SEC registrant), on February 12 of this year. Custodianship was granted on March 18. Tracy arranged a sale fairly quickly, and reinstated the company’s corporate charter in Nevada on April 27. The sale must have at that time been tentative; he inserted his own name as sole officer and director. On July 29, he filed a new officer list, indicating that Brandon and Harvey Romanek had taken over as management.

In August, the company’s name was changed to THC Therapeutics at the Nevada SOS. The website for THC Therapeutics was added to GOFF’s profile page at OTC Markets. In mid-July, Brandon Romanek had complained in a message sent from the company website that Tracy was dragging his feet, but THC would be going public in the very near future, and that “quite a lot” of information would soon be forthcoming. Yet no information appeared. On October 21, a new amendment was noticed at the Nevada SOS: the company’s name had been changed back to Goff Corp.

The Romaneks are still listed as officers of Goff in Nevada. Perhaps they simply terminated the deal because Tracy was taking too long to complete the merger. Perhaps they learned that GOFF, which had once been the vehicle for a major Awesome Penny Stocks pump and dump operation, had been discussed at length in SEC litigation against a host of penny scammers including Philip Kueber, who was subsequently indicted by the Department of Justice, and pled guilty. Or perhaps they suspected FINRA might balk at a request for a name and ticker change. In any case, it is now clear that the GOFF shell will not be the new home of THC Therapeutics. That will not please investors who bought in recent months hoping it would become yet another hot pot stock.

On Monday, October 24, Brandon Romanek made a few tantalizing comments on his Twitter account:

Romanek isn’t Tracy’s only dissatisfied customer. On September 16, 2016, a company called GF Offshore Energy and Resources Ltd. sued him and his Securities Compliance Group for breach of agreement, fraud, breach of fiduciary duty, conversion, legal malpractice, misrepresentation, conflict of interest and more. GF Offshore is a Nevada company formed in July 2015; it is located in Malaysia.

According to the complaint, when GF Offshore turned to Tracy and Securities Compliance Group for help in going public, Tracy proposed that he sell the company China Ivy School (CIVS), which, as explained above, was one of the first Nevada shells he acquired. GF Offshore evidently understands that Tracy was granted custodianship of CIVS; what it does not realize is how and when that happened. It stipulates that “during 2015,” it exchanged email with Tracy laying the groundwork for the sale of China Ivy to GF Offshore for the sum of approximately $100,000. It adds:

On October 6, 2015, Tracy advised authorized agents of GF OFFSHORE that, “Upon my receipt of the remaining contractual balance due of $29,809, I will proceed with finishing my end of the arrangement. This includes, changing the name of the company ….., restructuring the company to include new investors, inserting operating assets into the company, and turning control of the company over to the proper parties, among other matters.” This payment was made on October 7 and confirmed by Tracy on October 13, 2015. Since that date, no further progress has been made and not one of the promises contained within the emphasized statement has been completed. More promises of performance have been made but only further delay has been the result.

On October 6, 2015, Tracy did not control CIVS. He didn’t even apply for custodianship until November 25. Custodianship wasn’t granted to Barton Hollow until January 27, 2016. And yet, by GF Offshore’s account, he’d accepted a substantial amount of money from the company on October 7, 2015, for an entity he did not own or control.

To make matters worse, GF Offshore says it was told by Tracy that its newly-acquired public shell would require a transfer agent:

An agreement was delivered to Plaintiff’s agents, dated December 1, 2015, between GF OFFSHORE and Cathedral Stock Transfer, LLC, and designated as the Transfer Agent and Registrar Agreement between the company and the transfer agent. At that point in time GF OFFSHORE was a private company, not public, was not trading and had no need for a transfer agent. This agreement was for the benefit of China Ivy, the corporation dominated and controlled by Tracy, and which did need a transfer agent, although it already had one: Cathedral Stock Transfer.

Cathedral Stock Transfer is another of Tracy’s companies. As we’ve seen, it’s listed among OTC Markets’ Service Providers, but does not claim any clients. No transfer agent is named on the profile page of China Ivy. Still more astonishingly, Tracy represented that he’d give GF Offshore a hefty discount on the agency’s services: it would make only a single payment of $30,000, rather than $37,200 for payment over time. GF Offshore says it paid the $30,000 in December 2015, only belatedly realizing that other transfer agencies charge only a few hundred dollars a month.

GF Offshore further claims Tracy told management it would have to pony up $8,000 to “list” with OTC Markets. OTC Markets doesn’t charge for companies to be traded; it charges for use of its OTC Disclosure & News Service. For Pinks like China Ivy, that costs $5,000 a year. GF Offshore dutifully wired the money to Tracy’s trust account on February 25, 2016, along with an $875 fee supposedly due to the Nevada SOS. According to GF Offshore, neither OTC Markets nor the state of Nevada had been paid by the date of filing of the lawsuit; China Ivy’s corporate charter has not, in fact, been reinstated in Nevada. That would require payment of another $5,550. Astonishingly, GF Offshore also states that despite the agreement it believed it had, and the payments it had made, “it learned that other persons and entities were being offered control of China Ivy, on a program or package similar to the proposal given to GF Offshore.”

GF Offshore says it’s paid Tracy “an amount in excess of $101,310 when interest is added.” And it has received nothing in return. No exhibits were filed with the complaint, though it may be hoped they’ll be made available as the action progresses. We don’t know whether GF Offshore had an actual contract with Tracy, or if their business with him was conducted only by email. GF Offshore’s management, Malaysians unfamiliar with the U.S. penny market, seem to have been gullible newcomers who put their trust in Tracy and the representations he made at his Securities Compliance Group website. They didn’t hire their own securities attorney until, they claim, they’d spent more than $100,000 on empty promises.

The summons in the case was issued on October 17; Tracy will need to answer or otherwise respond within 21 days from the day after it was served on him. His defense will no doubt be interesting. Should GF Offshore’s allegations prove to be true, it will also be interesting to see whether Tracy has collected money from multiple potential buyers for the purchase of other Nevada shells, and whether he’s collected other funds in excess of those required by OTC Markets and other service providers.

Adam Tracy’s new career as a shell peddler is not yet over. He’ll probably make more sales. So far, the regulators have done nothing meaningful to stop him. Though he appears to be under investigation by the SEC, he continues to apply for custodianship of new shells in Nevada, without disclosing that investigation as he is required to do. Twelve of his shells are delinquent SEC registrants; they could be suspended for their delinquency in the blink of an eye, but the SEC hasn’t done that either. The Nevada court could be informed of the SEC investigation; that hasn’t happened, either. The SEC says it feels strongly about the dangers presented by dormant public shells. If so, it’s time for them to take action.

For further information about this securities law blog post, please contact Brenda Hamilton, Securities Attorney at 101 Plaza Real S, Suite 202 N, Boca Raton, Florida, (561) 416-8956 or by email at [email protected]. This securities law blog post is provided as a general informational service to clients and friends of Hamilton & Associates Law Group and should not be construed as, and does not constitute, legal and compliance advice on any specific matter, nor does this message create an attorney-client relationship. Please note that the prior results discussed herein do not guarantee similar outcomes.

Hamilton & Associates | Securities Lawyers

Brenda Hamilton, Securities Attorney

101 Plaza Real South, Suite 202 North

Boca Raton, Florida 33432

Telephone: (561) 416-8956

Facsimile: (561) 416-2855

www.SecuritiesLawyer.com