Paul Pelosi Jr’s Adventures in Pennyland

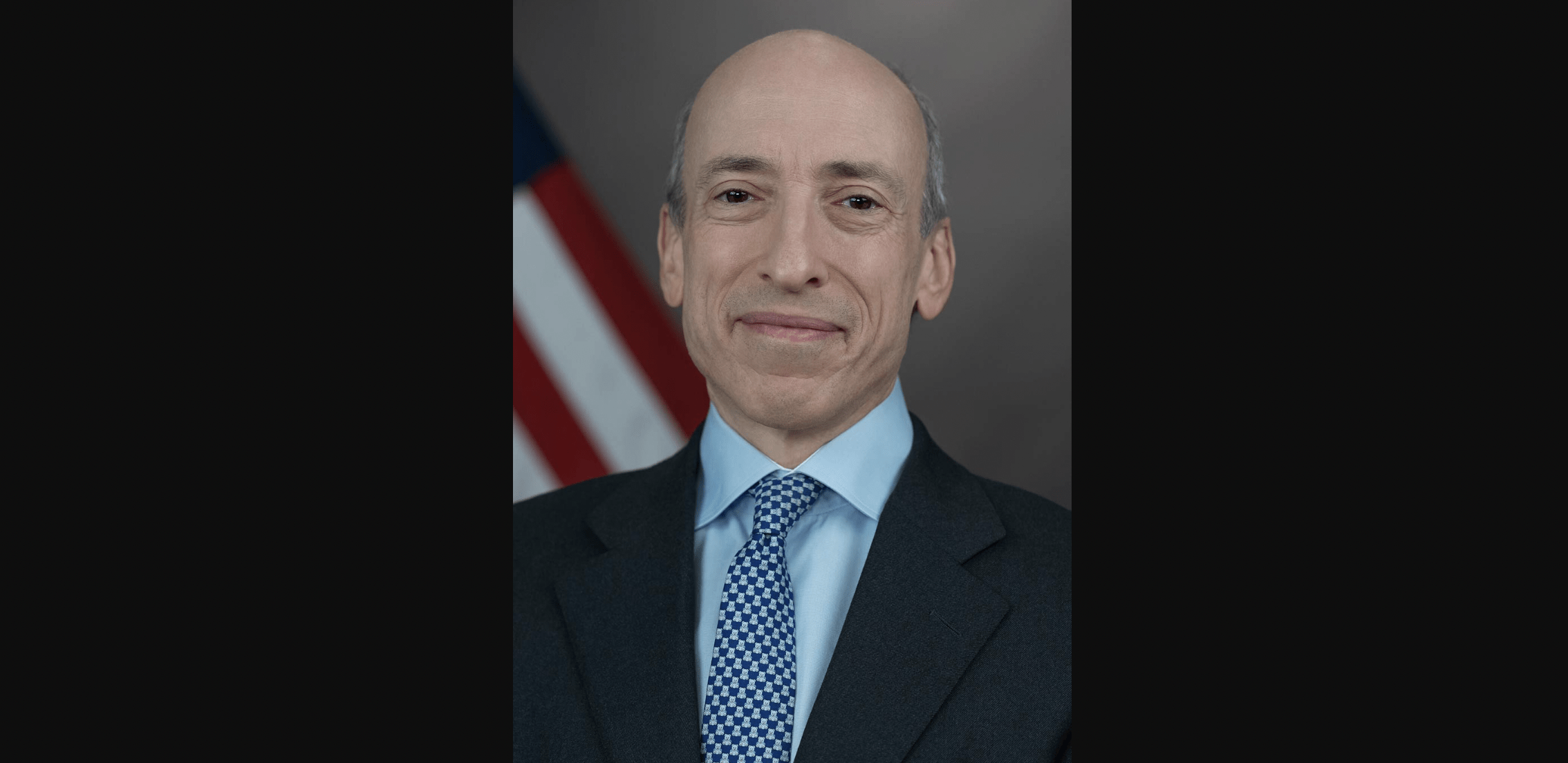

In mid-January 2022, British tabloid the Daily Mail published a long story about U.S. House Speaker Nancy Pelosi’s son Paul Jr, in which it was alleged that he’d been involved in a number of shady businesses, some of them targets of Securities and Exchange Commission investigations and enforcement actions. The piece was subsequently picked up by the NY Post and several Republican political organs. We’ll take a look to see if there’s any fire to go along with all the smoke.

Paul Pelosi Jr is the only son of Nancy and Paul Pelosi; their other four children are daughters. (One of them, Alexandra, memorably said of her mother on CNN: “She’ll cut your head off and you won’t even know you’re bleeding.”) Like his siblings, Paul isn’t a kid; he’s 52 and has worked as an attorney and environmentalist since he was in his 20s. He graduated from Georgetown University and has been a member of the California Bar since 1996 and a California real estate broker since 2002. He’s been fairly low-profile in his business and personal life. His sisters Christine and Alexandra are better-known.

At LinkedIn, Paul lists Due Diligence, Corporate Finance, Start-ups, Corporate Development, Venture Capital, New Business Development, Investment Banking, and more as “skills” he possesses, and at which he presumably excels. Early in his career, he worked for Bank of America, but more recently, he’s been associated with smaller enterprises, some of them startups. As everyone who follows the OTC market knows, that choice can present its own dangers.

The Mail says that Paul “was involved in five companies probed by federal agencies—but has never been charged himself,” adding that “[a] shocking paper trail shows Paul Pelosi Jr.’s connections to a host of fraudsters, rule-breakers and convicted criminals.”

Forms 211: OTC Markets’ New Role – Quotation, Trading Suspensions and Listing

We’ve written several times about the Securities and Exchange Commission’s (“SEC”) amendments to Rule 15c2-11, first proposed in September 2019 and adopted in September 2020. The amended rule will finally become effective on September 28, 2021. That is important because no stock that trades over-the-counter can trade at all unless it’s compliant with the relevant provisions of the rule.

The Financial Industry Regulatory Authority (“FINRA”) has always played a significant role in the practical application of Rule 15c2-11. It once administered and operated the OTC Bulletin Board (“OTCBB”) and dealt with the issuers that traded on it. Just before the turn of the new century, the SEC decided that all OTCBB companies had to register stock with the Commission or be dumped to the lowly Pink Sheets. The Pinks had recently been purchased by a group of investors who believed they could make a go of them, and they went on to do just that, eventually changing the name to OTC Markets Group. The OTCBB died a slow death, largely due to FINRA’s lack of interest and failure to innovate; on September 17, FINRA announced it would “retire” the OTC Bulletin Board entirely at a date not yet fixed, but probably in the fourth quarter of this year. (That announcement has been made several times in the past five years; the OTCBB seems always to be on its way out but not quite gone.)

FINRA continues to process corporate action requests by OTC issuers and to process Forms 211. When an issuer wants to initiate or resume quotation until now, it’s needed to find a sponsoring market maker willing to file a Form 211. In order to do so, he needed to obtain information from the company, including financial statements that needed to be accurate but not audited, and send the completed form to FINRA. If anything in the documentation is incorrect, the sponsoring market maker could be found liable. He was not permitted to charge for preparing and submitting a Form 211.

Emerging Growth Company Status and the Going Public Process

Going public offers many benefits to companies seeking to grow their business, including:

- Enhanced ability to raise capital,

- Liquidity for founders and shareholders,

- Increased visibility

- Improved financial position,

- Enhanced credibility,

- Enhanced ability to attract and retain employees and

- The ability to offer valuable incentives to employees and consultants.

An Emerging Growth Company is defined as an issuer with total annual gross revenues of less than $1.07 billion during its most recently completed fiscal year. Status as an Emerging Growth Company offers many benefits to issuers going public. Most companies quoted on the OTC Markets OTC Link qualify as Emerging Growth Companies.

SEC Pursues Unregistered Dealers, Toxic Financing, Toxic Convertible Notes

2020 and 2021 have been historic years for Securities and Exchange Commission (“SEC”) enforcement action against toxic lenders as unregistered dealers. We recently wrote about the interesting SEC enforcement actions that examine toxic financings and the question of whether the individuals and entities that purchase convertible promissory notes from public companies are “dealers” according to the definition established in Section 15(a)(1) of the Securities and Exchange Act of 1934 (“Exchange Act”).

Informally known as “toxic lenders” or “dilution funders” because the terms of their financing agreements contain provisions that almost always result in harm to investors and issuers alike, they’re considered by many to be the scourge of the penny stock market. Typically, the notes they buy can be converted at any time, often at a discount to market price of 70 percent or more. As the lender converts and sells, stock price drops. To avoid making insider filings to the SEC, the lender’s financing agreements specify that he may own no more than 4.99 percent of the company’s stock at any time. But that in no way stops him from converting his note continuously, in a succession of tranches. Since the conversion ratio is pegged to the security’s recent average bid price, every time he converts, he gets more stock than the time before. As he sells tranche after tranche, the company’s stock price enters freefall. Sometimes the only remedy for the issuer is a large reverse split.

Read More